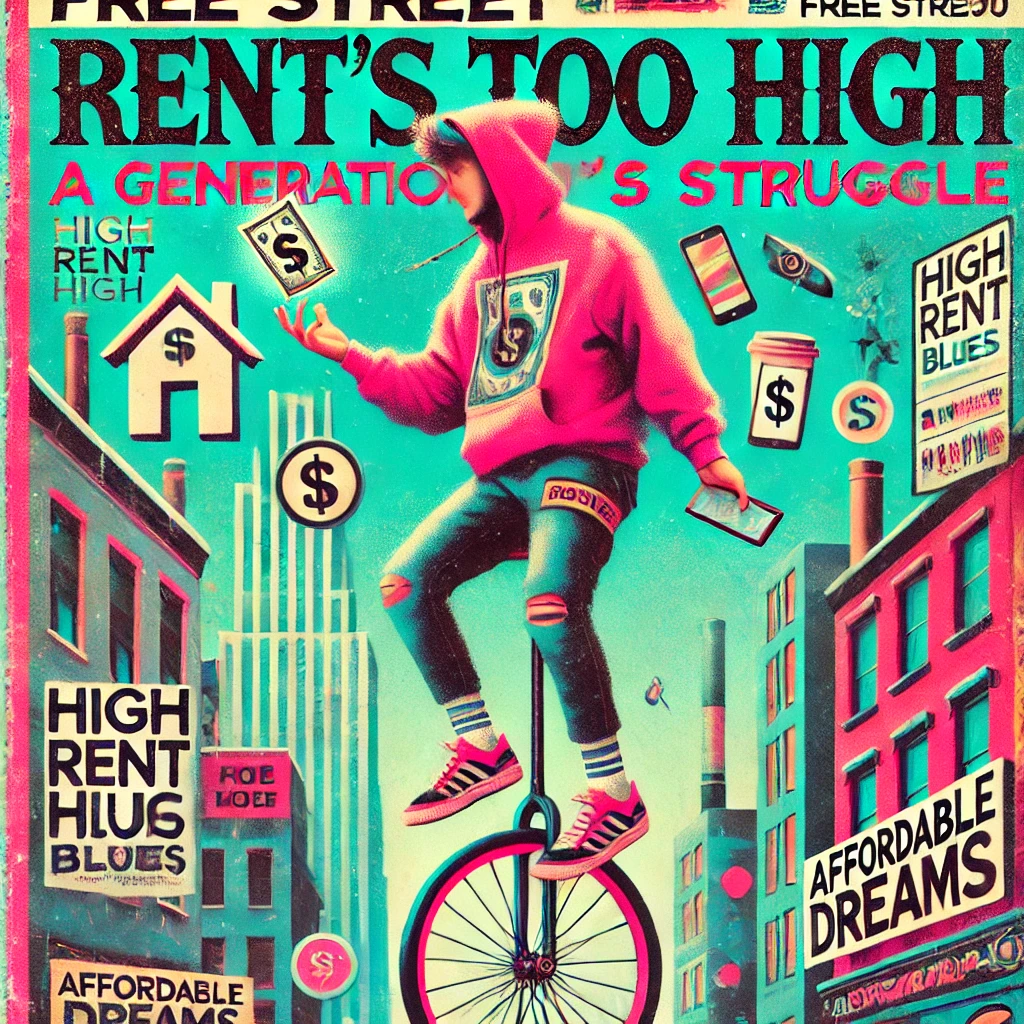

Once upon a Christmas splendid in the country's bustling capitals Gen Z was thriving. The vibe was immaculate: share houses with fairy lights and Spotify playlists, weekend brunches worthy of a million Instagram stories, and savings accounts that at least had potential. But 2024 hit harder than the latest plot twist in The White Lotus. Now? The rental crisis has arrived, and it’s giving main-character-in-a-horror-movie energy.

Picture this: rent prices are popping off like the hottest sneaker drop. In Sydney, they’ve skyrocketed 18% in just a year. Melbourne? A spicy 14%. And Brisbane isn’t holding back with a 16% hike. Wages? Yeah, they’re still in 2019. Inflation? Cooking everyone alive. Add in the cost-of-living crisis, and every rental inspection feels like The Hunger Games. Spoiler: there’s no Katniss to save the day, just overpriced shoebox apartments with a three-week waitlist.

And don’t even think about avocado toast anymore—RIP to those wholesome brunch vibes.

Why the Australian rental market is straight-up unhinged

Okay, here’s the tea. This rental chaos isn’t random; it’s a toxic combo of demand, supply, and everyone wanting to live their main-character life in the city:

- Demand Explosion: Post-pandemic vibes brought back international students, new migrants, and city-loving locals. Now, every rental inspection looks like a mosh pit where the prize is a kitchen with barely working appliances.

- Supply Is a Joke: Landlords are holding out for bigger bucks, Airbnb is snatching long-term rentals, and new buildings? Slower than trying to download a movie on 2008 WiFi.

- Cost-of-Living Crunch: Everything—groceries, petrol, utilities—is expensive AF. Add rent, and it’s game over for life’s little luxuries. No houseplants. No bubble tea. Just existential dread.

Let’s be real—being a Gen Z hustler used to come with a hint of glam. Side gigs were edgy, share houses were vibey, and there was at least some hope that your avocado toast habits wouldn’t ruin your future. Now? The rental crisis has flipped the script, and we’re out here dodging financial ruin like it’s a side quest we didn’t ask for.

Share house struggles: The Darwinian edition

Once upon a time, stuffing five people into a share house felt like the ultimate cheat code. Sure, someone always left dishes in the sink, but at least you weren’t broke. Now? Even cramming into a half-decent place feels impossible. Every inspection is Hunger Games-level competitive, and roommate drama has hit a new high. Stress over rent payments is turning the chillest housemate into a walking red flag. Is this survival of the messiest? Probably.

Buying a house? LOL, good one. Traveling? Only if camping counts, because the Europe fund just got converted into next month’s rent. Even saving for a secondhand laptop feels like hitting the lottery these days. Big goals are on hold while we focus on the ultimate grind: survival.

Financial stress isn’t just an inconvenience—it’s a whole personality now. The “just make it work” vibe is officially exhausting, and burnout city is becoming home base. We’re trying to stay afloat, but honestly, can the universe throw us ONE bone? Just one?

Where the money's (Not) going

When rent eats up 70% of your paycheck, every other expense feels like a debate with your inner minimalist. Gen Z’s cutting corners left and right, and the vibe is giving “surviving, not thriving.”

- Streaming? Canceled. We're too busy getting an old fashioned chilling by late stage capitalism to have the energy for Netflix. Yeah, that was an easy one. Subscriptions are out, and concerts? Maybe next lifetime.

- Nights Out = DIY Chaos. Who needs bars when you’ve got boxed wine and a backyard? Ubers are for the rich; walking home is the new cardio.

- DIY Dining: Forget brunch; toast with a side of existential dread is the new special. Cooking isn’t about vibes anymore—it’s about cheap calories.

- Travel Dreams? Grounded. Europe’s out of the question. Now, “wanderlust” means a road trip to the middle of nowhere. Hope you packed your marshmallows.

Non negotiables

Even when life’s a hot mess, Gen Z knows what’s sacred. Some things just can’t be sacrificed:

- Mental Health: Skincare, therapy apps, and a little self-care splurge? We’re broke, but we’re not neglecting ourselves. Boundaries, people.

- WiFi = Life: No internet means no jobs, no memes, no sanity. Phones and data plans are staying put.

- Community Vibes: Broke or not, we’re still showing up for causes, GoFundMes, and grassroots campaigns. Supporting the crew >>> everything.

The big picture: hustling for hope

Here’s the thing: Gen Z’s scrappy, resilient, and always down to hustle, but the rental crisis is pushing us to the edge. It’s not just about tightening budgets; it’s about navigating a system that’s stacked against us.

Until governments, landlords, and policymakers stop snoozing on the problem, we’ll keep grinding—hustling to pay rent, sipping boxed wine, and dreaming of a day when stability feels like more than just a distant goal. Gen Z’s vibes are unmatched, but even we need a break. ✌️